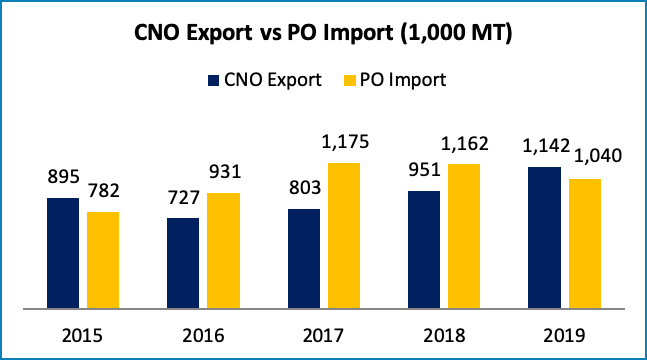

Philippines maintained its position as the top importer of Malaysian palm oil in the ASEAN region. In 2019, the country imported 1.3 million tonnes of oils and fats and palm oil is the major imported oil with the share of 81% which equal to 1.04 million tonnes. As for local production, Philippines is the largest coconut oil producer in the world with the share of 37% of global coconut oil production. 71% of coconut oil supply in the country being exported due to its high price in the world market because it’s being used in the high value added products such as in oleochemical sectors.

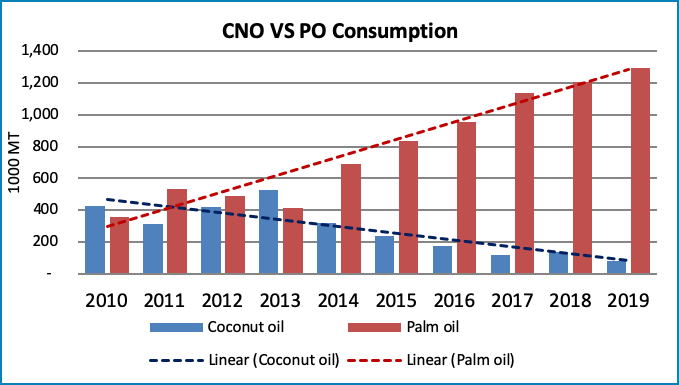

Palm oil is the main consumed oil in the Philippines which accounted about 73% of total oils and fats consumption in the country in 2019. The trend of palm oil consumption in the Philippines has showed positive growth with compound annual growth rate (CAGR) at 13.7% from 2010. Coconut oil is being replaced by palm oil in domestic consumption due to the widening price discount of palm oil over coconut oil. However, coconut oil is still the preferred oil for the Filipino, as long as prices remain stable.

According to USDA report, for marketing year 2020/21, coconut oil production is expected to decline due to the reduction in copra harvests and the trees will face biological rest after two consecutive years of heavy nut-bearing. Besides, United Coconut Association of the Philippines (UCAP) estimated that the effects on of Typhoons Kammuri and Phanfone, which struck Philippines in December 2019, will show starting in late 2020. Low coconut oil production will prompt an increase of palm oil imports.

RBD Palm Olein is the major type of palm oil exported to the Philippines. The cooking oil market has shown an impressive growth rate owing to growth in number of households, enhancing food processing sector, rapid rise in tourism and hospitality sector. The increasing tourism in Luzon, Western Visayas and Mindanao will increase the number of hotel chains and restaurants sector in the country, thus will boost the demand for palm oil in the country. In addition, growing middle class consumers which will change the Filipino’s lifestyle will also spur the demand of palm oil. Palm oil has bright opportunities in the Philippines. It is projected that palm oil consumption in the Philippines will reach to 1.8 million MT in 2025 compared to 1.3 million MT in 2019.

Preventive measure undertaken by the Philippines government due to the COVID-19 outbreak may slightly affect the palm oil consumption and import in 2020. Philippines extended the lockdown in the Metro Manila and other provinces until May 15. This lockdown has affected sales in various sector such as food services, food manufacturing and hotel & tourism.

| Q1 2020: Malaysian Palm Oil Top 5 Destinations | |||||

|---|---|---|---|---|---|

| No. | Country | Jan – Mar 2020 | Jan – Mar 2019 | Diff (MT) | Diff (%) |

| 1 | China | 481,652 | 571,253 | (89,601) | (15.68) |

| 2 | Netherlands | 304,678 | 233,338 | 71,340 | 30.57 |

| 3 | Pakistan | 284,776 | 288,412 | (3,636) | (1.26) |

| 4 | Philippines | 184,982 | 158,629 | 26,353 | 16.61 |

| 5 | USA | 162,348 | 146,143 | 16,205 | 11.09 |

| Source: MPOB | |||||

Philippines ranks as the fourth largest palm oil export destination for Malaysia imported about 184,982 MT which increased by 16.61% compared to the first quarter in 2019. The increase in Malaysian palm oil export to Philippines was mainly due to the price spread between palm oil and coconut oil which makes it more attractive for domestic consumption especially for food applications. For the month of March, the price spread of coconut oil and palm oil was USD201 compared to USD115 in February 2020 which increased about USD85 or by 74%. In conclusion, for the year 2020, it is anticipated that Malaysian palm oil export to Philippines will drop slightly about 1 to 2 percent due to the current global pandemic outbreak.

Prepared by: Rina Mariati & Muhammad Kharibi

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.